The Photographers’ Guide to Finances and Budgeting

Spreadsheets and sums. Never as much fun as cameras and creativity.

But when you’re running a photography business, there’s no escaping the financial responsibilities.

Alongside nurturing clients, planning shoots and managing your diary, you also need to maximise profitability. Are as many pennies as possible being spent wisely? Is some belt-tightening required?

Here we’ll share some practical tips for managing your finances efficiently and budgeting carefully for software, equipment and marketing.

1. Assess Your Financial Situation

First things first, get your mathematical brain switched on and take a thorough look at where you currently stand money-wise. A comprehensive review of sources of income, expenses and savings will give you the necessary starting point.

If you don’t already have them in place, consider setting some financial goals. Start small to build a foundation and boost your confidence, then expand on them to create long-term security.

Short-term, maybe your aim is to save for that gorgeous new lens that will transform your shoots. Long-term, perhaps you’d like your own studio rather than hiring a space when needed.

Whatever your business dream, making yourself accountable will drive you on to achieve and succeed.

2. Budget for Equipment

Your equipment stash may be magnificent or modest, but budgeting for additions and upgrades needs to be planned carefully.

We all know it ain’t cheap, so knowing in advance when your business can afford to splash out will mean you can easily set a date for the next big purchase. And if your new gadget is something that will attract more clients, when you can invite them to book in.

Do your research – your favourite supplier might not be offering the best deal – speak to colleagues about any sneaky places they source their stuff and keep your eyes peeled for discounts.

3. Budget for Software and Tools

Professional photographers can save plenty of time, money and head-scratching by using the right tools for their business.

Whichever ones are vital to you, budgeting for them is pretty straightforward. You generally have a monthly or yearly fee to pay and a regular date on which to pay it.

If you feel some of the fees are getting a little steep, research alternatives. Take a look here for insight into accounting software for photographers.

And if you fancy really streamlining all your online operations, moving everything to a CRM for photographers, like Light Blue will free you up to pay just one subscription to cover all your needs. Alongside organisational tasks like creating workflows and automating client emails, you can also log and track all your income and expenditure.

4. Allocate a Marketing Budget

A happy bookings diary depends on a healthy marketing strategy. And this can often be an area to explore spending and find savings.

Knowing what works for your business and what echoes into the void will help you tailor your budget. So if you have a few years of ROI stats to assess, you can easily allocate pounds to projects.

If social media ads are too costly to reach significant numbers but your website traffic is booming from organic search, you can focus spend on updating it with regular fresh content.

If attending shows feels fruitless but an email marketing campaign brings in the bookings, make sure you have a clear strategy in place for content and frequency.

This insight will be a huge help while setting your budget.

5. Track Expenses and Revenue

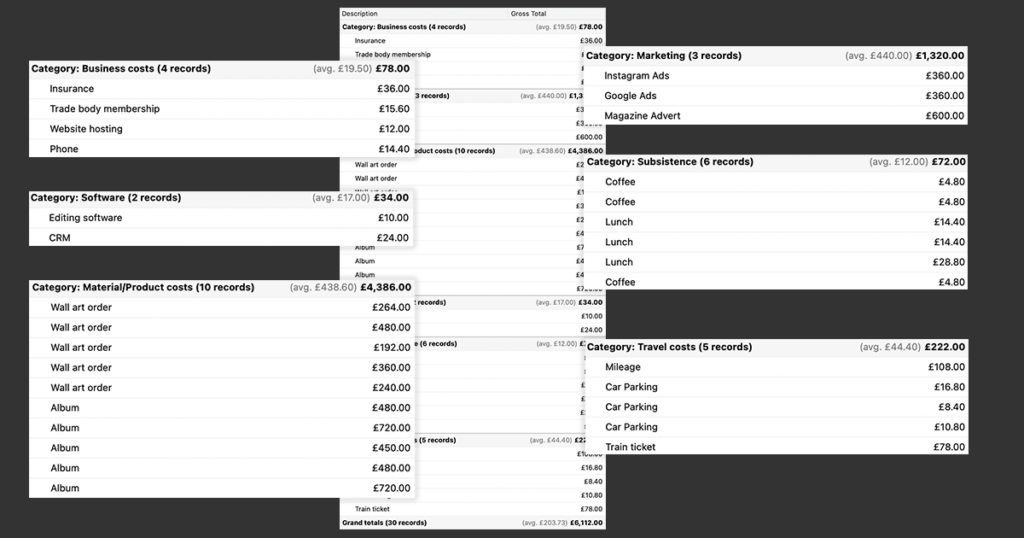

An admin task we’re all familiar with is logging businesses income and outgoings. It can be less of a chore when you use accounting software to make an accurate digital record.

The reports produced by specialist platforms means you can regularly and easily review your business performance and make informed decisions.

6. Seek Cost-Saving Opportunities

Budgeting well requires not just considering the big expenses but also shaving off small amounts here and there.

You can also evaluate the return on investment for various expenses. This may sometimes be difficult to quantify but, for example, if you buy a lens designed to work underwater, you can easily cross-reference with the number of shoots where it proved essential.

Take a look at whether you can reduce expenditure in any key areas. Get some more pointers here about where you could streamline and save.

7. Build an Emergency Fund

Recent research reveals that 1 in 7 adults don’t have any savings. Whichever group you fall into regarding your personal finances, saving for a rainy day – or should we say an empty diary? – is crucial for your photography business.

Make a plan to set aside a portion of your income for emergencies or unforeseen circumstances. And make this a separate pot to any cash you’re putting to one side to pay your tax.

If your business has regular seasonal lulls – and you’ll increasingly recognise these as the years go by – this fiscal safety net will keep you solvent when the going gets quiet.

And whether you keep this emergency fund in an easy-access ‘savings space’ in your bank account or move it into a savings account to generate interest, it will provide priceless financial reassurance.

8. Get Professional Financial Advice

Software has made day-to-day accounting for photography businesses infinitely less daunting. But not many of us are financial strategists and if you feel you need more insight into how to boost your bottom line, a professional accountant or financial advisor can give a helping hand.

Their expert guidance will help you develop a comprehensive, long-term strategy to guide your decisions.

They’ll talk you through savings options and retirement planning to give you complete control over everything from today’s expenses to your future pension.

Get your sums right, set your budgets tight and you’ll be setting up your business for long-term success.

Related

- How to Manage Photography Client Expectations

- How To Attract Your Ideal Photography Clients

- Book more clients by phoning your leads - tips for making successful calls

- Using Sales Data to Drive Smart Upselling

- How to deal with difficult clients

- The Ultimate Guide to Selling Wedding Albums: Insights from Folio Albums and How Light Blue CRM Can Boost Your Sales

- How to Find a Consistent Photography Client Base

- How to Get More Word-of-Mouth Referrals

- How to Automate Time-Consuming Tasks

- How to Give an Exceptional Client Experience