Search for answers or browse our knowledge base.

Can't find the answer you need here? Contact our support team and we'll gladly help you.

🎥 Light Blue Payment Schedules: An overview

Payment Schedules allow you to easily break an invoice down into smaller payments due at different points in time either before or after a session.

Having the ability to offer a payment plan to your clients makes payments more manageable and affordable so they perhaps may book you more readily. They may also be inclined to place larger orders or indeed book a bigger package than they might have done if the invoice had to be paid all in one go.

There’s lots of flexibility with how you can set up the individual instalments that make up a Payment Schedule. You can even include automatic Payment Reminders; great for saving more of your valuable time! And with just a few clicks of the mouse they’re easily applied to any Sale Record.

To learn more watch the video below; though if you prefer to learn by words and pictures, have a read of the help article instead!

NB. Please do make sure you follow any applicable laws and regulations before offering payment plans to your clients; these will vary from country to country.

The Payment Schedule and it’s instalments

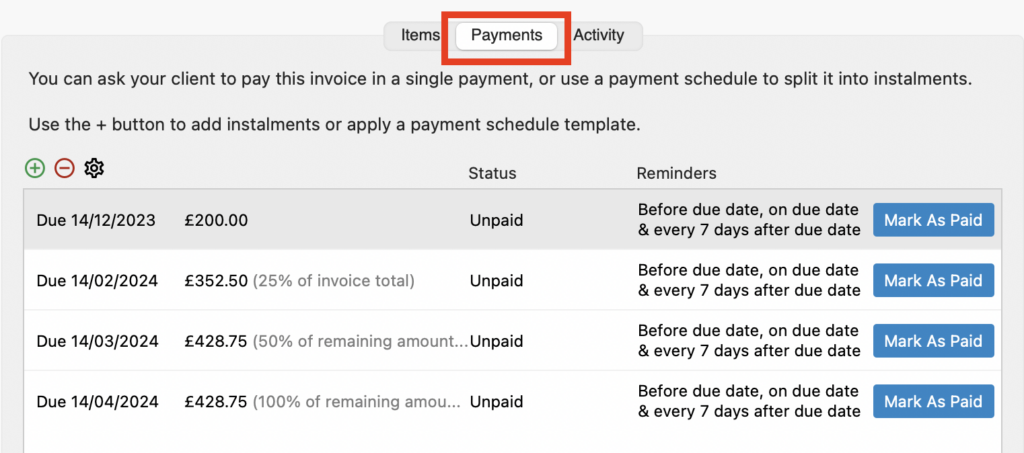

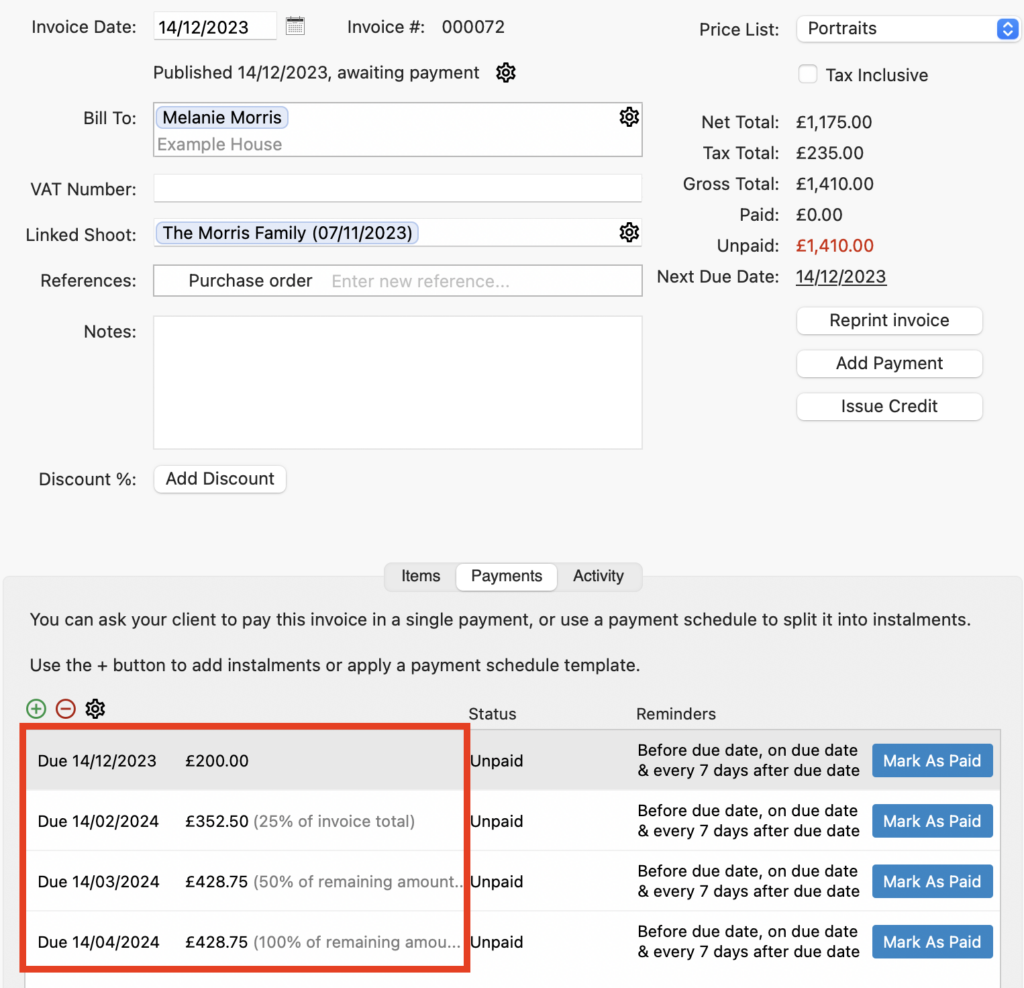

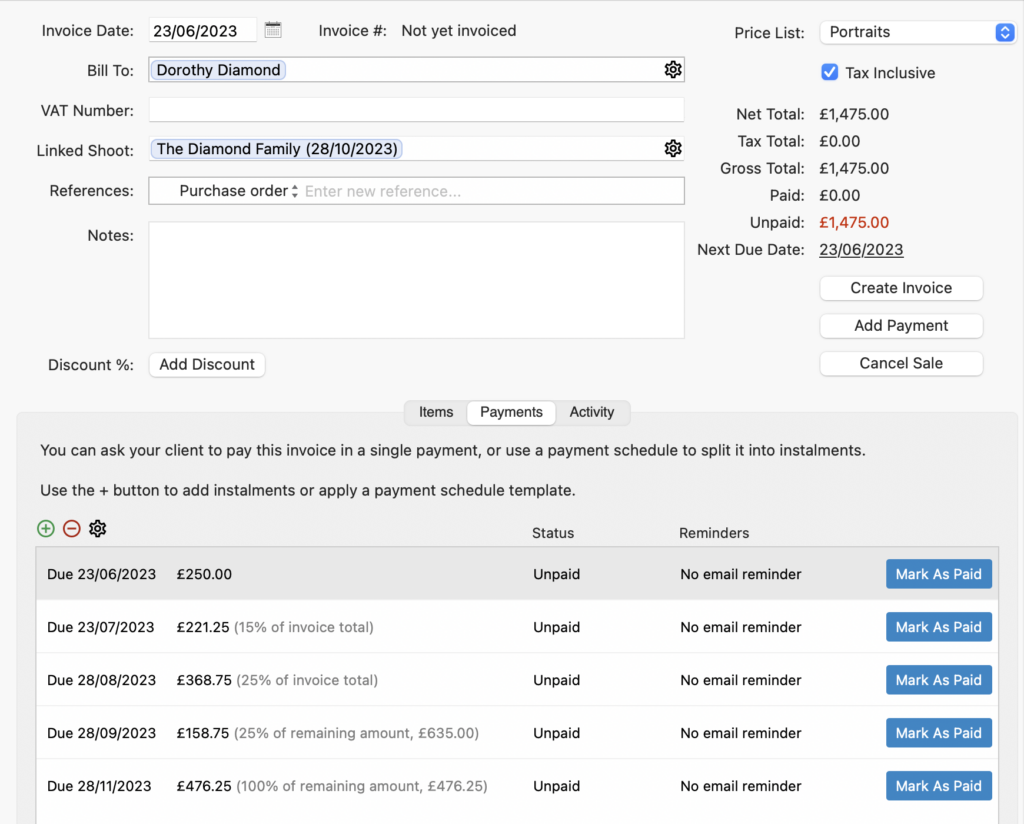

The Payment Schedule for any Sale Record is found in its “Payments” tab.

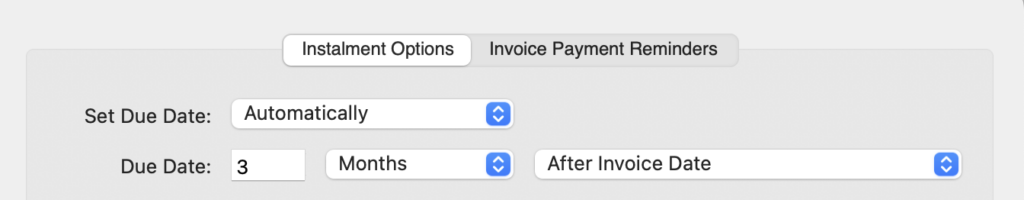

A Payment Schedule can include as many instalments as you want. The due date for each instalment can be set to an automatic number of days, weeks or months after the invoice date, or before or after the shoot date, or you can manually set the date.

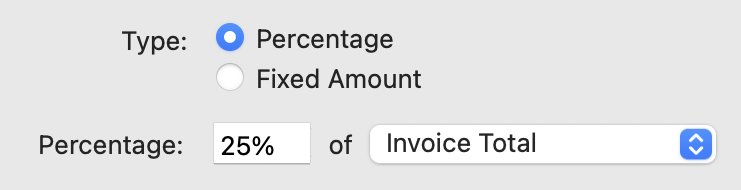

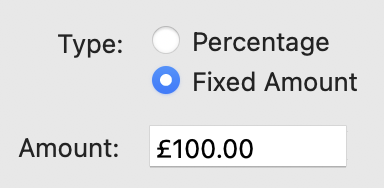

Each instalment can be for either a fixed amount or a percentage of the remaining amount or invoice total.

The example below shows four instalments; one a fixed amount due on the invoice date, and the remaining three as a percentage of both the invoice total and remaining amount due at different dates after the invoice date.

Payment Schedule Examples

So you can see how Payment Schedules work in practice here are a few example scenarios:

- If you’d like the invoice to be paid with a single payment a Payment schedule with a single instalment of “100% of the remaining balance” is all that is needed with the option to set the due date relative to the date of the invoice, the date of the linked shoot, or manually select a date.

- A portrait photographer can ask a client to pay for a large print order in a number of monthly instalments.

- An event photographer can ask for part of the balance before the shoot and then final payment on completion.

Payment Schedule Templates

Unless the Payment Schedule for every Sales Record is unique you can save a lot of time by creating Payment Schedule Templates for your more frequently used instalment combinations.

⭐️ Top Tip: You can save even more time if you set Payment Schedule Templates as Defaults for any new Sales Record or particular Shoot Types. 👉 If you haven’t already set up Payment Schedule Templates or set them as Defaults this guide explains how to do so.

Applying a Payment Schedule Template

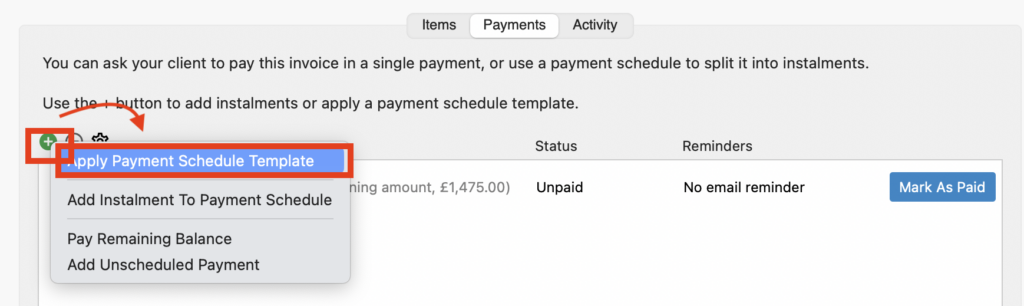

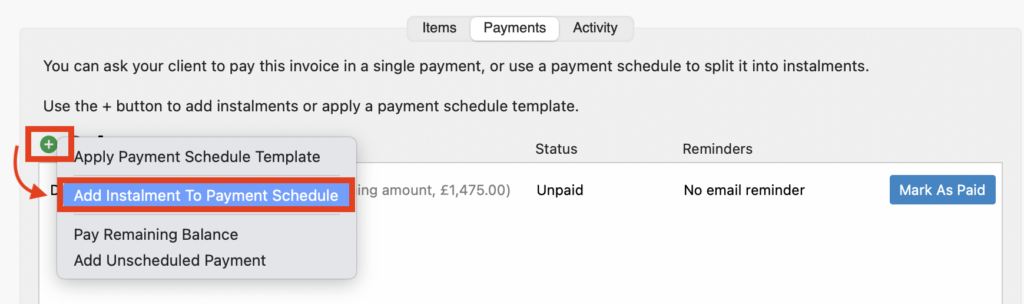

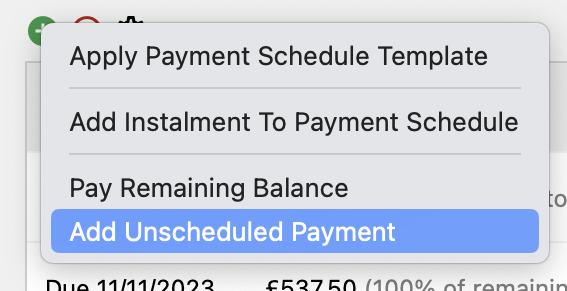

- A Payment Schedule Template can be added to the Sales Record by clicking on the green “+” button and choosing “Apply Payment Schedule Template” from the dropdown menu.

Manually adding a Payment Schedule to a Sales Record

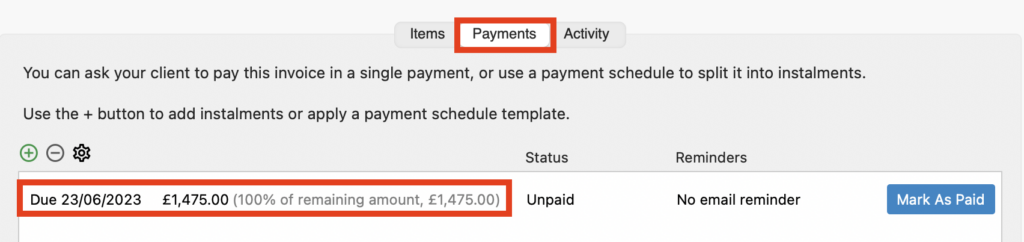

Unless you’ve applied a default Payment Schedule Template to the Shoot Type, when you create a new Sales Record from the Shoot Record, Light Blue automatically adds one instalment to the Payment Schedule; 100% of the remaining amount due on the invoice date.

We always recommend you keep this instalment in case anything changes on the invoice or your client makes some unscheduled payments, indeed Light Blue will warn you if you forget to include a “100% of the remaining amount” instalment.

Single instalment

- You may wish to change when this single instalment is due. Simply double-click on it and change the date accordingly. As explained above you can set this to an automatic number of days, weeks or months after the invoice date, or before or after the shoot date, or you can manually set the date.

Adding instalments

- If you want to break the payments into smaller instalments for your client, click the green “+” button and choose “Add Instalment To Payment Schedule” from the dropdown menu.

- Create the details of the instalment; the Due Dates can be set as explained above and then the Type of instalment can either be for either a fixed amount or a percentage of the remaining amount or invoice total.

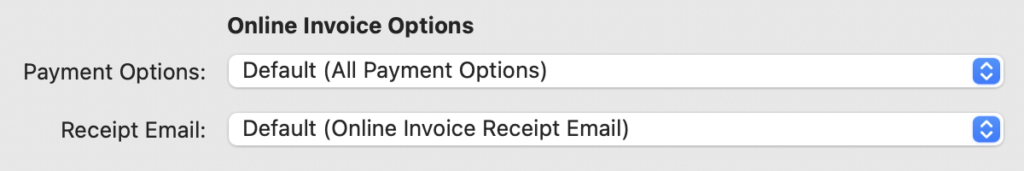

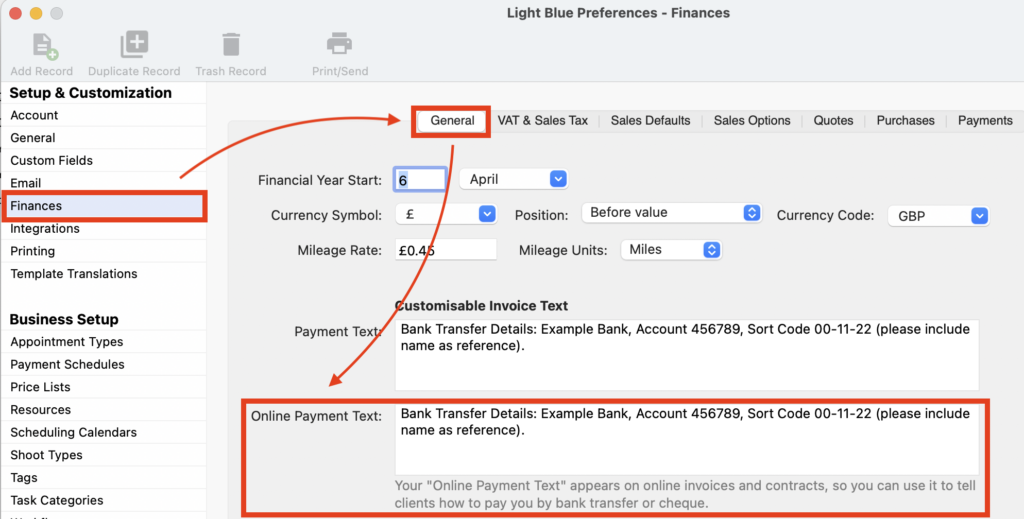

- You can choose whether your client can pay online through your Client Portal or not, including which Email Receipt Template will be automatically sent to them if they pay online. 👉 If you’re not sure how to set up Email Templates this article explains how to do so. NB. Do make sure you’ve completed the Online Payment Text field in the Preferences Finance section so that your offline payment options are shown on the online invoice.

- As soon as you add an instalment Light Blue will automatically calculate the amount and due dates for it and apply it to the Payment Schedule – unless of course you set a fixed date and manually chose a date!

- Then repeat as many times as needed; there are no limits to the number of instalments you can add to a Payment Schedule and you can have completely different variables in each instalment too!

⭐️ Top Tip: Adding automatic Payment Reminder emails to each instalment is a great way to ensure you get paid on time as well as saving you more valuable time! 👉 If you want to set them up this guide explains how to do so.

Creating an Invoice from the Sales Record

Once you’re happy with the Payment Schedule for the Sales Record you need to create an Invoice for the sale; this will then ensure that any automatic Payment Reminder emails are sent to your client. 👉 If you’re not familiar with how to do that, this guide explains how.

Recording payments in Light Blue

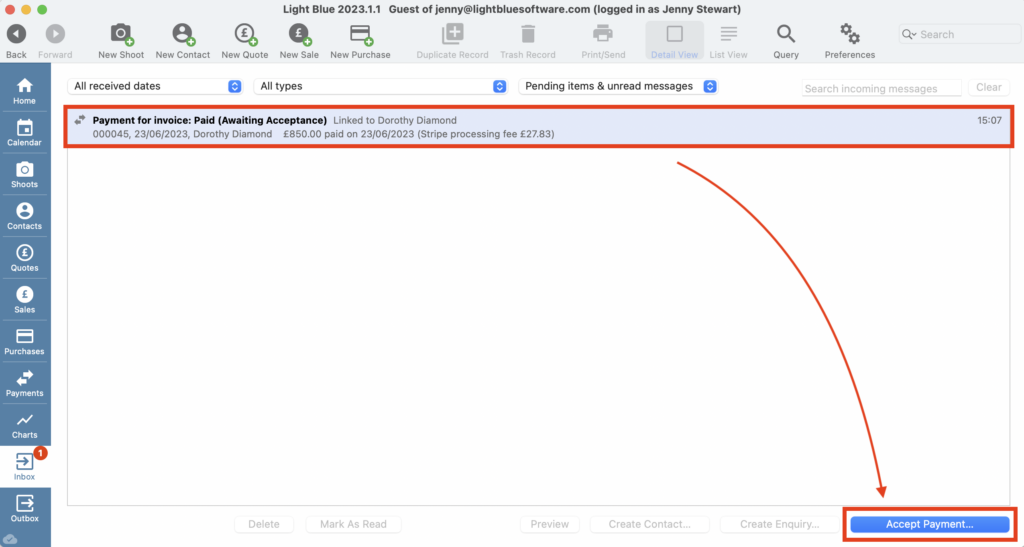

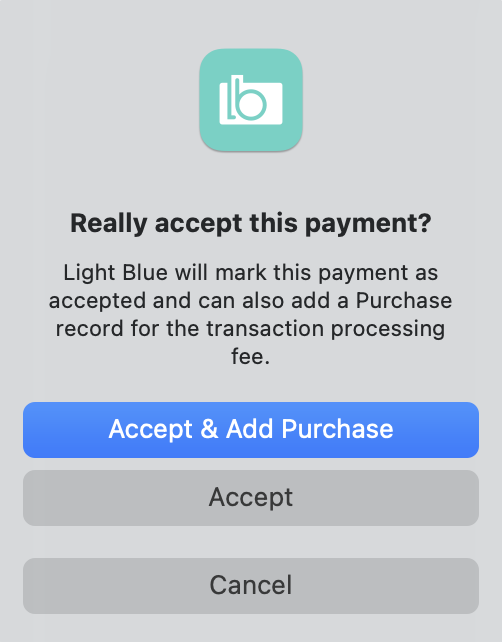

Online payments

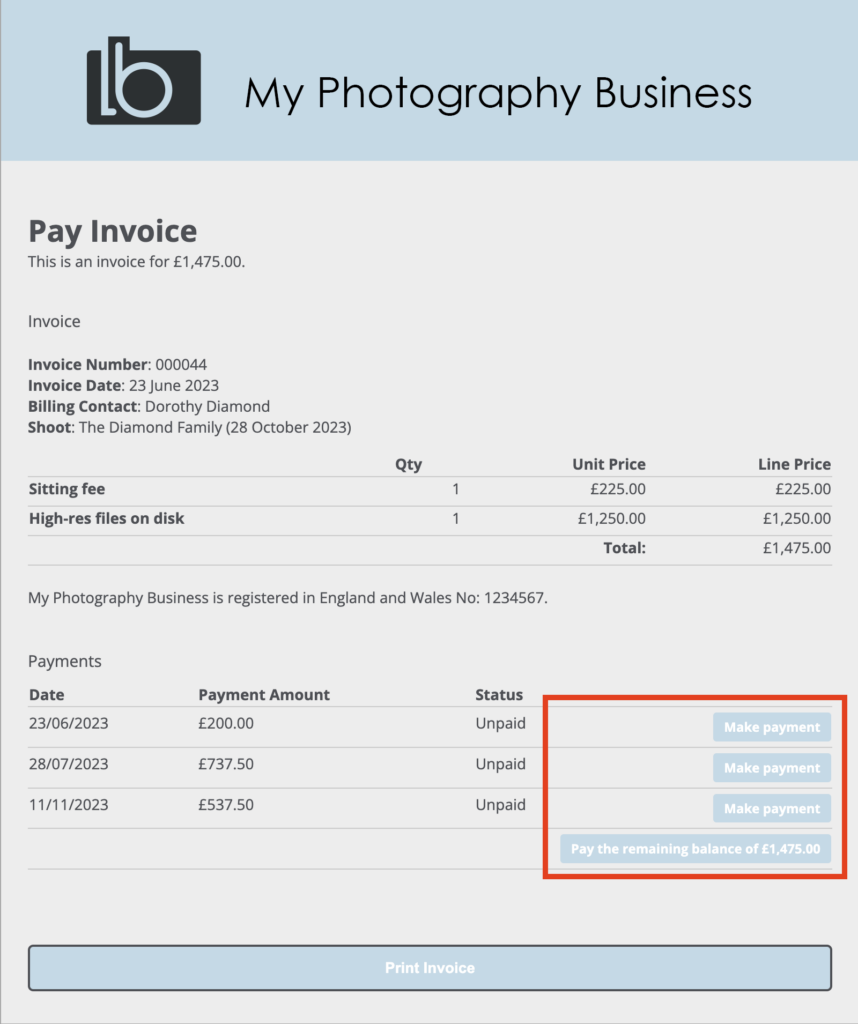

- If you’ve set this option up in the Payment Schedule instalments, your client is able to pay each instalment when it’s due; they can also pay any remaining balance in one go if they want to too!

- When payments are made they’ll appear in your Light Blue Inbox; simply accept them to mark the invoice as paid. Light Blue will also give you the option to create a Purchase Record for the transaction fee at the same time.

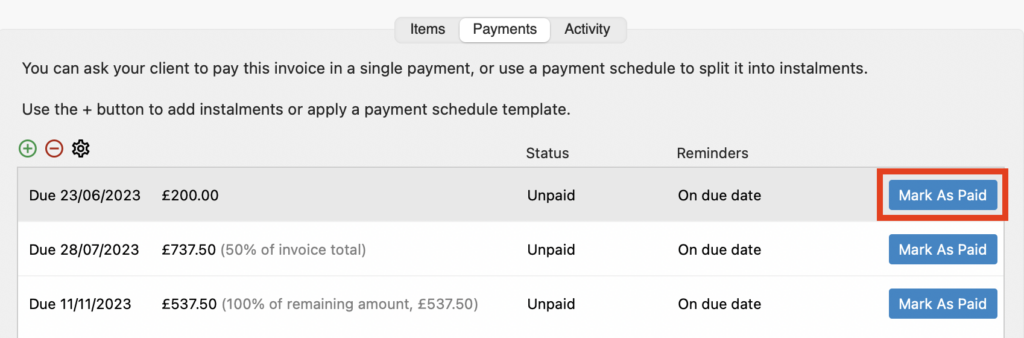

Offline payments

- If your client pays an instalment by bank transfer or any other form of offline method you will need to mark that instalment as paid in the Invoice Record; simply click the “Mark As Paid” button and enter the details of the payment.

- If your client makes an unscheduled payment simply click on the green “+” and choose “Add Unscheduled Payment” from the dropdown menu.

Payment Schedules and financial reporting

When a Payment Schedule is applied to a Sales Record the full amount is recorded as being invoiced on the date that the Invoice Record is created.

If your business works on a cash basis (i.e. the payment date is used to record your income) there will be no change to your Income and Expenditure reports when you use Payment Schedules.

If however, you work on an accrual basis (i.e. the invoice date is used to record your income) you may prefer to raise separate invoices for each instalment, particularly if they’re split over several months or indeed different tax years.